How to Protect Your Business with KYC: A Step-by-Step Guide

In an era where digital transformation is driving the financial industry, keeping up with evolving customer expectations and cyber threats is paramount. Customers today seek convenience, speed, and security in every interaction digital transaction with their financial service providers. They expect to open accounts, apply for loans, and make transactions from the comfort of their smartphones, with just a few taps and no compromising their security..

The New Battles Against Cybercrimes and KYC

The new cybercrimes and cyber threats have continued to emerge since the COVID-19 pandemic began and into this post-COVID era. In fact, many experts believe that the corporate and personal cyber security landscape has become more complex and challenging than ever before. Considering these new threats, it is not an exaggeration to talk about a new era for KYC. In response to the unique challenges of the new environment, institutions are urged to proactively enhance and modernize the procedures and services employed throughout the Know Your Customer (KYC) process. This initiative aims to provide customers with more versatile and user-friendly experiences while ensuring strict compliance with Anti-Money Laundering (AML) regulations.

According to the World Economic Forum's Global Cybersecurity Outlook 2023 , by 2025, advances in 'user identity and access management' are among the technologies with the greatest impact on cyber risk strategies, at 15%. As one solution that have been using by many financial firms worldwide, especially in tackling fraud cases related to financial aspects and in trades related to money, know-your-customer (KYC)/anti-money laundering (ALM) technology is already a part of the strategy and representing a mandatory process to complete many daily tasks such as onboarding new clients and maintaining existing accounts. In the face of new cyber threats, businesses not only in the financial industry but also in other fields are increasingly adopting KYC as a solution, aiming for both user security and a powerful experience. As highlighted in a report published by Facts & Factors, the analysis of , the E-KYC ( or called paperless KYC ) market share is likely to grow above a CAGR of around 21.55% between 2022 and 2030.

Know Your Customer (KYC) is a versatile and indispensable process that finds application in a wide array of use cases across different industries from financial institutions, such as banks, credit unions, payment service providers or cryptocurrency exchanger, to government agencies, from e-commerce platforms to gaming industry and telecommunication companies, all rely on KYC to identify and verify the customers, to ensure the legitimacy of users and comply with anti-money laundering regulations. This widespread adoption of KYC underscores its versatility and critical role in modern business operations, emphasizing its value as a security and compliance measure across various sectors.

KYC regulations can indeed vary from one country to another. While there are common principles and guidelines that align with international standards – for example, see the Financial Action Task Force’s recommendations (FATF), each country may implement its own specific regulatory framework and operational process for KYC ( see, Unique Identification Authority (UIDAI) in India) The differences can stem from various factors, including the country's legal system, financial industry structure, risk assessment, and regulatory authorities. However, the primary purpose of KYC regulations is to prevent financial crimes, including money laundering, terrorist financing, fraud, and other illicit activities, etc.

Thus, KYC emerges as a critical component of the modern user-centric digital landscape. KYC is not just a regulatory requirement; it's a strategic enabler for creating the secure, frictionless experiences customers crave.

KYC: The Foundation of Trust

At its core, KYC is about verifying the identity of your customers. It's about ensuring that the person or entity on the other end of the digital transaction or any other financial operation is who they claim to be. While this might seem like a regulatory box to tick, it's much more than that. KYC builds trust. It's the digital handshake that reassures customers that their financial institution is committed to protecting their data and assets. It's the foundation upon which long-lasting customer relationships are built. When customers feel secure, they're more likely to engage with your services, trust your advice, and become loyal advocates for your brand.

KYC: Enabling Seamless Experiences

Moreover, KYC is the gateway to seamless online experiences. Imagine a new customer wanting to open an account with your institution. In a KYC-enabled environment, this process can be swift and straightforward. The customer submits their identification documents digitally, and advanced identity verification technologies validate their identity in real-time. This reduces friction, eliminates the need for lengthy in-person visits, and accelerates onboarding. KYC is not just about the initial interaction; it's about every step of the customer journey. It enables institutions to streamline transactions, detect and prevent fraudulent activities, and offer personalized services—all while maintaining regulatory compliance.

Adopting KYC in the Digital Age

As financial institutions transition from legacy systems to agile, customer-centric digital platforms, KYC plays a pivotal role. Modern KYC solutions leverage cutting-edge technologies such as artificial intelligence and biometrics to provide swift, accurate, and compliant identity verification. By embracing KYC, financial institutions can not only meet regulatory requirements but also deliver on the promise of secure, seamless online experiences. KYC isn't just about compliance; it's about staying competitive and meeting the expectations of today's tech-savvy customers.

Shortly, KYC is the bridge between regulatory compliance and customer-centric innovation. It's the key to unlocking the full potential of secure and seamless online customer experiences in the digital age. As financial institutions seek to thrive in this rapidly evolving landscape, KYC stands as an indispensable ally on the path to success.

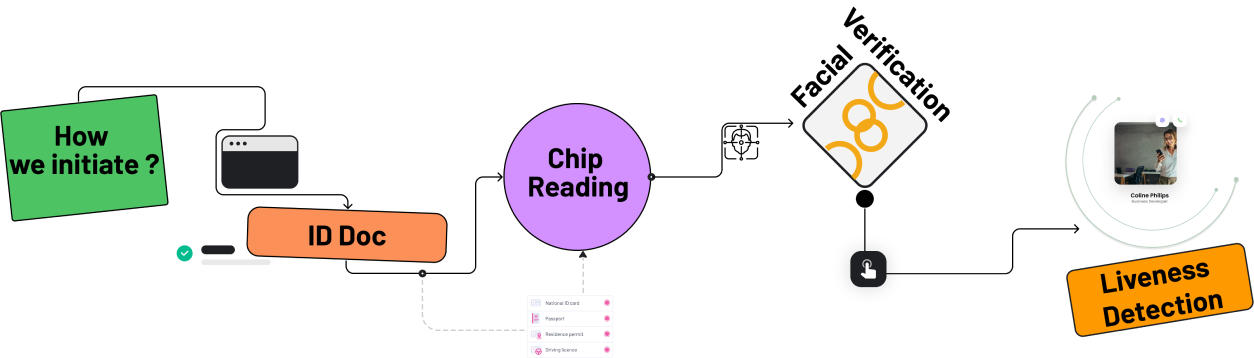

KOBIL's customer-centric KYC journey exemplifies a seamlessly secure process that places paramount importance on both convenience and security. Here's a comprehensive overview of the entire journey:

Initiation: The journey begins when the customer expresses interest in your financial services, typically through a mobile app or online platform.

ID Document Presentation: The customer is guided to present their ID document to the system, which initiates MRZ reading to capture essential personal information like the customer's name, passport or ID number, date of birth, and nationality. This data is captured using advanced Optical Character Recognition (OCR) technology that provided by KOBIL’s KYC.

Secure Chip Reading: Following MRZ reading, the journey proceeds to the next critical step—NFC (Near Field Communication) reading from the ID chip. If the customer's ID document is equipped with an NFC chip, this step securely extracts personal information and a biometric photo from the chip (by applying passive and active authentication to the ID chip). The information retrieved include details such as address, expiration date, and any additional biometric photo stored on the chip. This step ensures the integrity of the customer's identity data.

Facial Verification: With the personal information in hand, the KYC journey moves on to face verification. Here, the customer is prompted to take a selfie with their mobile phone. Cutting-edge facial recognition technology of KOBIL compares this selfie with the biometric photo obtained from the ID chip in the previous step. This robust verification process ensures that the person presenting the ID document and taking the selfie are indeed the same individual. It's a crucial security measure to prevent identity theft.

Liveness Detection: Finally, the KYC journey concludes with the last step—liveness detection. In this phase, the selfie photo taken by the customer is scrutinized for any signs of spoof attacks or fraudulent activities. Liveness detection technology assesses whether the photo is of a live person or a static image. Passive liveness detection module of KOBIL during the selfie are employed to verify the live presence of the individual. This step adds an extra layer of security to ensure the authenticity of the KYC process.

This end-to-end KOBIL KYC journey not only fulfills regulatory requirements but also prioritizes the customer's digital experience. It offers a secure, efficient, and frictionless way for customers to access your financial services while protecting your institution from potential danger.

By verifying and understanding the identities of individuals or entities, businesses and financial institutions can mitigate risks, protect against money laundering and terrorist financing, and maintain the integrity of their operations. KYC not only ensures compliance with legal and regulatory requirements but also fosters trust and security in financial markets and the broader business landscape. In a digital age where financial interactions often occur remotely, the significance of KYC in preventing fraudulent activities and preserving the legitimacy of transactions cannot be overstated, making it an indispensable element of modern commerce.

In today's dynamic and increasingly risk-prone digital landscape, where new and sophisticated spoofing attacks continually threaten the digital identities of individuals, the fortification of KYC becomes an imperative. This can be achieved by seamlessly integrating an array of cutting-edge security tools and technologies, thus ensuring robust protection against emerging threats and safeguarding the integrity of digital identities.

Indeed, leveraging KOBIL's cutting-edge technology, such as their risk monitoring and behavior detection system based on smartphones, can significantly enhance the KYC process to provide an even more secure and user-friendly experience for customers.

About KOBIL

Since 1986, KOBIL GmbH has been revolutionizing security solutions as a leading technology provider. Offering cutting-edge solutions for application shielding, user authentication, transaction authorization, and more, KOBIL is a market pioneer in digital identity and mobile security management. With over 500 employees worldwide, KOBIL is trusted by 5000+stakeholders from banks to SMEs and start-ups. KOBIL plays a vital role in the development of new encryption standards and has been recognized as a sample vendorin five Gartner Hype Cycles. KOBIL's solutions are trusted by some of the world's largest organizations, including the German Government,Raiffeisen, Erste, ING, Airbus, DATEV, Migrosand Siemens.KOBIL's recent innovation uniting all identity talents within a SuperApp platform highlights its commitment to compliance and innovation. KOBIL GmbH is the most visionary and market-leading provider of secure data technology solutions, with over 100+ million end users benefiting from its solutions.